While running any business, every business engages in a business transaction on a day-to-day basis. It could be other business entities (B2B), or customers (B2C). Further, it may be on a ‘Cash’ or ‘Credit’ basis. And keeping proper track of it is very important to understand the overall health of a business. As a businessperson, it is crucial to understand when, where, how the money flows into/out of your business.

What is journal in accounting?

To keep track of your day-to-day business transactions, capturing the details of each transaction is very important. The basic information that must be tracked is the Date of the transaction, the purpose of a business transaction which has mainly two-fold effect, a brief explanation of the transaction, and its amount. The activity of recording this business transaction into the books of accounts of a business is called Journalising.

In Accounting terminology, the first step in an accounting cycle is to record a journal entry of a business transaction by following a double-entry system. Every transaction will impact at least two accounts, one being ‘debited’ and other ‘credited’ with an equal transaction amount.

| Business Reports in TallyPrime | How to Record Multi-Currency Transactions in TallyPrime? |

For time being, just understand the following rule,

| Nature of transaction | Examples (Office/Factory purpose only) | Balance | Increase | Decrease |

| Assets | Machinery, Car, Furniture etc., | Debit | Debit | Credit |

| Liabilities | Suppliers, Taxes, Bank Loans etc. | Credit | Credit | Debit |

| Expenses | Telephone, Rent, Electricity, Labour charges, Employee Salary, etc. | Debit | Debit | Credit |

| Income | Sales, Interest earned on deposits etc. | Credit | Credit | Debit |

- Assets Account will always carry a ‘Debit’ balance, so when there is an increase in ‘Asset’ account value we will Debit the Asset account and vice-versa

- Liabilities Account will always carry a ‘Credit’ balance, so when there is an increase in ‘Liability’ account value, we will Credit the liability account and vice-versa

- Expenses Account will always carry a ‘Debit’ balance, so when there is an increase in ‘Expenses’ account value, will ‘Debit’ it and vice-versa

- Income Account will always carry a ‘Credit’ balance, so when there is an increase in ‘Income’ account value, we will ‘Credit’ it and vice-versa.

Let us understand this with a help of an example.

Example of journal in accounting

On 1st Nov ’21, Mehta Traders purchased Furniture @ 75000/- from Sharma Enterprises on credit (30 days).

Considering the above business transaction which is between two business entities – Mehta Traders (Buyer) & Sharma Enterprises (Seller), let us analyse how will it be recorded in the books of both the entities.

As Mehta Traders is buying from Sharma Enterprises so it is an expense for them. So, the two accounts involved in this business transaction is –

Furniture A/c – Asset

Sharma Enterprises A/c – Liability

When Asset is increasing you will ‘Debit’ the Asset account (Assets have a Debit balance)

When liability increases you will ‘Credit’ the liability account (Liabilities have a Credit balance)

Journal Book of Mehta Traders

| Date | Particulars | Amount (Dr.) | Amount (Cr.) |

| 1-Nov-21 | Dr. Furniture A/c | 75,000 | |

| Cr. Sharma Enterprises A/c | 75,000 | ||

| [Being Furniture @ 75000/- purchased from Sharma Enterprises on credit] |

Similarly, As Sharma Enterprises is selling the furniture to Mehta Traders, it is an income for them. So, the two accounts involved in this business transaction is –

Sales A/c – Income

Mehta Traders A/c – Assets

When sale is increasing you will ‘Credit’ the Sales account (Sales have a Credit balance)

When Assets increase, you will ‘Debit’ the Asset account (Assets have a Debit balance)

Select Product for Free Consultation

Journal Book of Sharma Enterprises

| Date | Particulars | Amount (Dr.) | Amount (Cr.) |

| 1-Nov-21 | Dr. Mehta Traders A/c | 75,000 | |

| Cr. Sales A/c | 75,000 | ||

| [Being 25 Washing Machines @ 75000/- sold to Mehta Traders on credit] |

Note:

- Furniture is an ‘Asset’ for Mehta Traders, hence, it will be tracked as ‘Furniture A/c’ and not ‘Purchase A/c’

- Furniture is ‘Inventory’ for Sharma Enterprises as he is into trading of furniture so it will consider under ‘Sales A/c’

To summarize the entry and give a comparative analysis –

| Sr. No. | Mehta Traders | Sharma Enterprises |

| 1 | Purchase of a Fixed Asset for office use | Sale of Furniture (inventory) |

| 2 | Sharma Enterprises is a liability as there will be an outflow of money due to purchase | Mehta Traders will be an Asset as there will be an inflow of Money due to sales |

| 3 | Dr. Purchase A/cCr. Sharma Enterprises A/c | Dr. Mehta Traders A/cCr. Sharma Enterprises A/c |

Journal voucher in TallyPrime

We discussed journal voucher above as per the accounting principle. However, from an accounting software’s (TallyPrime’s) perspective, each business transaction gets bifurcated basis the voucher types. So, in Tally you can see various voucher types viz., Purchase, Sales, Payment, Receipt, Journal, etc. instead of just one type of transaction (voucher) i.e. ‘Journal’.

Using different voucher types in TallyPrime basis the nature of transactions, will help you record your transactions and analyse your reports easily.

| Sr. No. | Transaction | Voucher Type in TallyPrime |

| 1 | To record a payment made to your Supplier | Payment |

| 2 | To record a receipt of money from your Customers/Clients | Receipt |

| 3 | To record purchase of goods from your Supplier | Purchase |

| 4 | To record sale of goods to your customers | ‘Sales |

The above helps you in faster data entry of transactions. But if this is the case, then the question that may crop up to your mind is that “When should I use ‘Journal’ voucher type?”

So, there is a specific use of ‘Journal’ voucher type. Let us understand by taking examples of few business transactions.

- When you buy a fixed asset for your business, for e.g., Machinery, Car, Furniture etc. You cannot record it in a ‘Purchase’ voucher type as you are not a trader of these fixed assets but using it for your office use. (As explained above in the case of Mehta Traders). If you were a trader like Sharm Enterprises, then you would have used ‘Purchase/Sales (basis the business transaction)’ instead of ‘Journal’

- To record depreciation for your fixed asset

- To record prepaid expenses (Amount paid but expenses will accrue over the months/year etc.)

- To record adjustment of taxes before making payment to the government department (Input vs. Output VAT)

- To record correction of entry due to wrongly debited/credited account

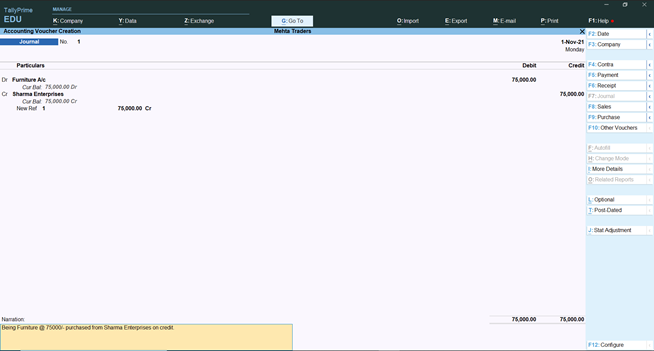

How to record a journal voucher in TallyPrime

Let us take the business transaction of Mehta Traders.

| Date | Particulars | Amount (Dr.) | Amount (Cr.) |

| 1-Nov-21 | Dr. Furniture A/c | 75,000 | |

| Cr. Sharma Enterprises A/c | 75,000 | ||

| [Being Furniture @ 75000/- purchased from Sharma Enterprises on credit] |

The above entry can be recorded in TallyPrime in these simple steps

| Step 1 | Gateway of Tally > Transactions (Vouchers) > F7: Journal |

| Step 2 | You may configure – Use Cr/Dr instead of To/By during voucher entry by pressing Press F12: Configure as per your preference |

| Step 3 | Select the transaction date as 1-Nov-21 by pressing F2: Date |

| Step 4 | Dr. Furniture A/c (Fixed Assets) and specify the value against it as 75,000, then Cr. Sharma Enterprises (Sundry Creditors)Note: In the ledger field, you can press alt and c keys to create ledgers on the fly and grouping it under Fixed Assets and Sundry Creditors respectively. |

| Step 5 | Specify the narration for future reference purpose |

| Step 6 | Press ‘Enter’ key to accept the transaction |

This is how Tally Prime UAE helps you to record the Journal voucher quickly and with simplicity!

Reference: https://tallysolutions.com/tally/journal-entry-in-tallyprime/